Automate fraud detection

Turn fraud risk and compliance management

into an opportunity

More checks. More efficiency. More security.

It's time to improve customer service productivity and ensure business continuity

- Free up your resources

Risk management is time-consuming. Automating fraud checks in the cloud enables you to be up-to-date with new risks and free up precious time for your strategic actions

- Don't allow any faults

Checks by sampling are fallible. Fraud detection robots systemise checks on 100% of documents without any additional resources

- Identify fraud right away

Only detecting fraud before payment really matters. Systemising document checks from their arrival in real time is key

- Stay in control with reliable data

Having exhaustive and reliable data available is the basis of effective management. Automatically checking 100% of data guarantees reliable dashboards and secure decision-making

- Guarantee auditability

Proving that checks were carried out is essential in the event of a dispute. Digitisation of checking processes tracks activities and guarantees auditability.

- Make your anti-fraud strategy known

Having an effective strategy for detecting fraud and improving your organisation’s image reassures your customers and partners, and contributes to reducing attempted fraud

Risk management is time-consuming. Automating fraud checks in the cloud enables you to be up-to-date with new risks and free up precious time for your strategic actions

Checks by sampling are fallible. Fraud detection robots systemise checks on 100% of documents without any additional resources

Only detecting fraud before payment really matters. Systemising document checks from their arrival in real time is key

Having exhaustive and reliable data available is the basis of effective management. Automatically checking 100% of data guarantees reliable dashboards and secure decision-making

Proving that checks were carried out is essential in the event of a dispute. Digitisation of checking processes tracks activities and guarantees auditability.

Having an effective strategy for detecting fraud and improving your organisation’s image reassures your customers and partners, and contributes to reducing attempted fraud

Maximise your efficiency

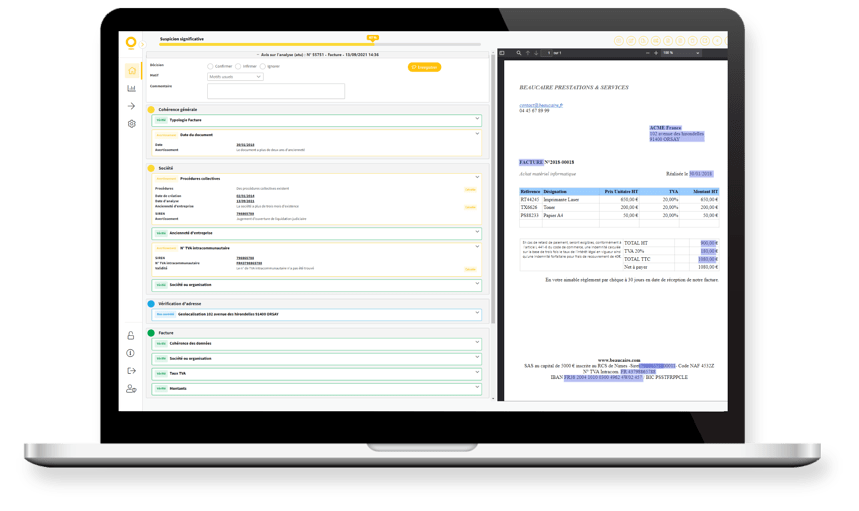

Automate risk detection and fight against fraud

Discover in 3 min how to:

- Systematically process 100% of incoming documents

- Carry out checks immediately, before any business processing

- Ensure the compliance of your operations

Fraud detection as a service

The only automated, ready-to-use fraud detection service

The service makes it possible to systemise checks on all your documents from the time of receipt and before any business processing. This unique approach combined with the best AI technologies dedicated to automatic document processing goes beyond the limits of traditional solutions.

.png?noresize&width=61&height=61&name=MicrosoftTeams-image%20(6).png)

Unique technologies

150+ consistency checks applied (amount, IBAN …)

All business lines, all processes

Cover all documents (supplier, HR...)

Plug-and-play service

Simple integration into information system

Committed to deliver the best performance

40 years of experience in the field of Intelligent Document Processing and business process automation ensuring your success

Technologies

A unique combination of OCR, AI and expert systems technologies

Business Expertise

Over 1000 digitisation projects with 650+ customers

Support

Fast, easy implementation with our innovative Quickstart method

Technologies

ISO 27001:2022 certified for all services provided by ITESOFT SaaS solutions

News

Procure-to-Pay: Fighting against fraud is no longer an option

Has your business fallen victim of fraud?

To respond to this growing threat, finance departments must now have tools capable of detecting fraud not only on data, but also on documents and processes. And to be perfectly effective, this detection must no longer be carried out “a posteriori” and on the basis of a test sample, but systematically on all invoices and “a priori”, meaning before payment.

Learn how to integrate these controls directly within the supplier invoice capture and discover our automatic fraud detection solution.

Insight

Fraud risks associated with Accounts Payable

Have you looked at a couple of key areas where fraud can be a risk, payment processing issues, and how to resolve these problems?

It is time to gain from insights into how to avoid some of the associated risks when processing invoices and capitalise on the advantages of financial automation.

Using a dedicated system, not only helps prevent fraud, but it also allows employees to focus on the more vital parts of the business rather than constantly working on processing invoices making work a lot more enjoyable.

Focus

Guarantee KYC without harming the customer experience

Financial institutions have to reinforce their customer checks, at the risk of being fined and losing their reputation in the case of failure to meet their obligations.

Guaranteeing this customer knowledge involves implementing a customer data collection mechanism, checks with third-party reference systems, regular updates, etc.

Through its automation solutions, ITESOFT helps companies to guarantee permanent KYC while ensuring a smooth customer experience!

Discover our articles

Discover our articles

La fraude aux processus financiers : un risque majeur

Factures falsifiées ou construites de toutes pièces, faux ordres de virement… Des techniques de fraude démocratisées par la dématérialisation des échanges.

Détecter la fraude avant paiement

Fraude à l’assurance, fraude aux prestations sociales, fraude à l'identité… Les tentatives de fraude touchent chaque année 7 entreprises sur 10 et coûtent cher : plus de 5% du CA des organisations selon l’ACFE.